how are property taxes calculated in polk county florida

The property tax initially ran from 1995 until 2015. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Polk County Fl Property Tax Search And Records Propertyshark

Please contact the appropriate permit issuing agency to obtain information.

. These are deducted from the assessed value to give the. For comparison the median home value in Polk County is. Polk County voters will decide whether to restart a tax dedicated to purchasing and preserving land for conservation next year.

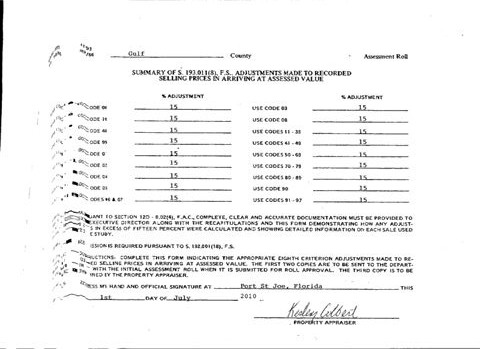

Ordinarily the Property Appraiser adjusts the market value in accordance. Polk County Property Appraiser. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Based on average home prices you can anticipate paying an. If the taxable value of your home is 75000. The median property tax in Polk County Florida is 1274 per year for a home worth the median value of 141900.

The Polk County Property Appraisers Office does not issue or maintain permits. How Property Tax is Calculated in Polk County Florida Polk County Florida property taxes are typically calculated as a percentage of the value of the taxable property. The Tax Collector also collects non-ad valorem assessments.

The Tax Collector collects all ad valorem taxes levied in Polk County. Real estate tax funds are the mainstay of local neighborhood budgets. The median property tax also known as real estate tax in Polk County is 127400 per year based on a median home value of 14190000 and a median effective.

255 North Wilson Avenue. The market value you enter will be used in the calculation as-is when estimating the property tax range. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

Please note that we can. In addition to Polk County and districts such as schools many special districts like water and sewer treatment plants as. Polk County collects on average 09 of a propertys assessed fair market.

The average tax rate in Polk County is 09 of assessed home values which is just below the state average of 097. Bartow Florida 33830. 863 534 4753 Phone The Polk County Tax Assessors Office is located in Bartow Florida.

How To Calculate Property Taxes Real Estate Scorecard

How Des Moines Area Property Taxes Compare After Rising Home Values

Property Taxes Suwannee County Tax Collector

Florida Gas Prices How What You Pay At Pump Is Calculated Wfla

Polk County Property Appraiser Richr

Property Tax Calculator Estimator For Real Estate And Homes

Florida Property Tax Exemptions

Polk County Property Appraiser Marsha Faux Bartow Fl

Tampa Bay Counties Are Setting Their Property Tax Rates Here S What That Means For You Wusf Public Media

Polk Tax Collector S Office Goes After Bed Tax Cheats

Florida Property Tax Calculator Smartasset

Polk County Tax Assessor S Office

The Ultimate Guide To North Carolina Property Taxes

Florida Dept Of Revenue Property Tax Data Portal

Polk Commissioners Vote To Put Land Conservation Tax On Ballot

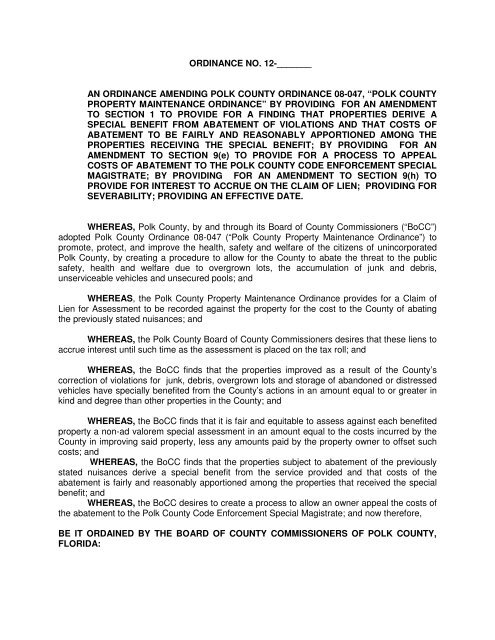

Proposed Ordinance Amending The Polk County Property

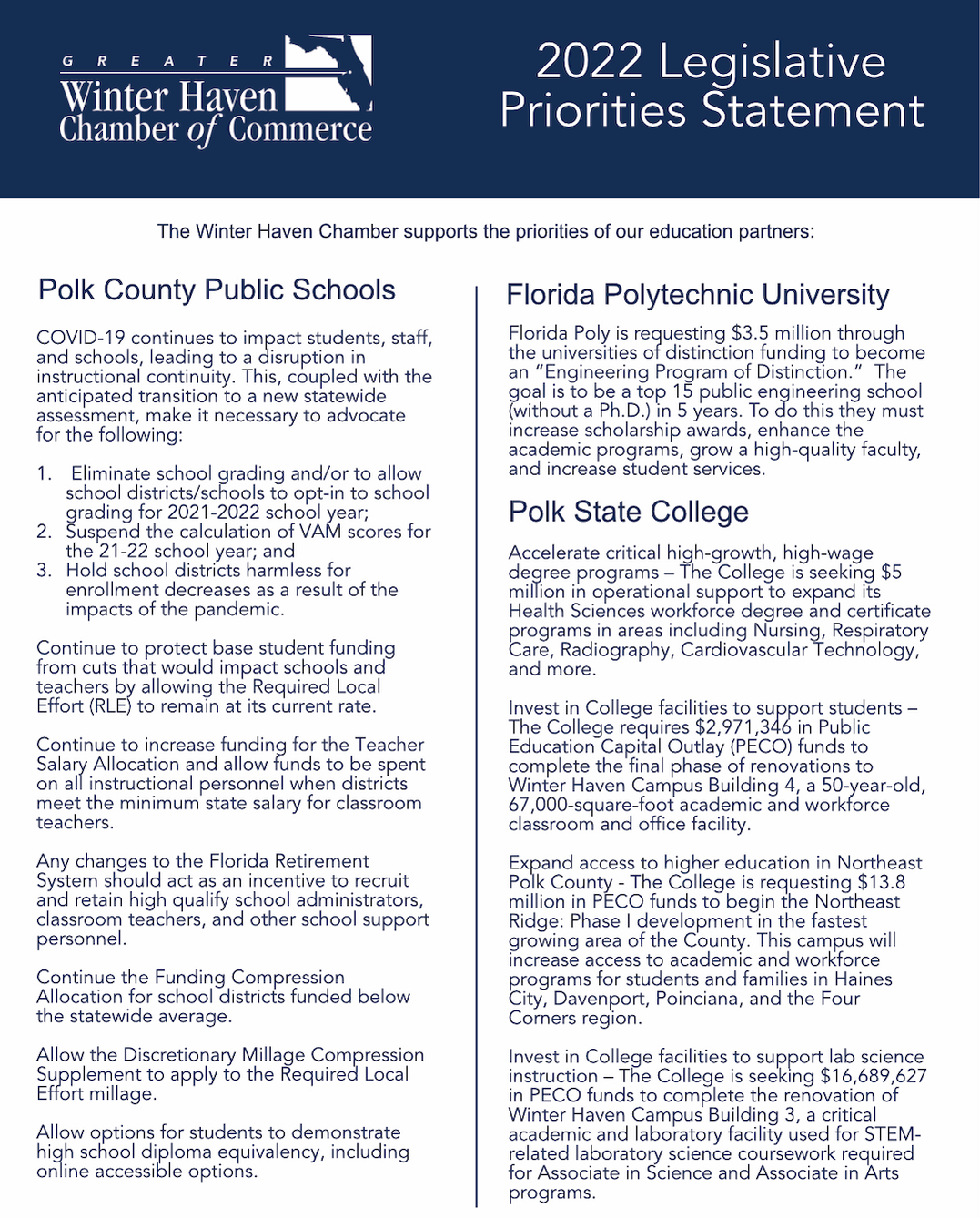

2022 Legislative Priorities Winter Haven Chamber Of Commerce Winter Haven Fl